|

||

|

||

| ||

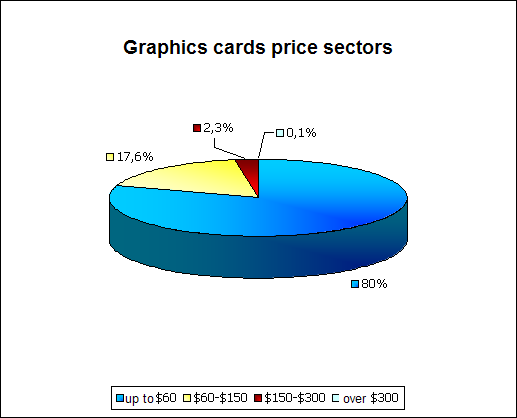

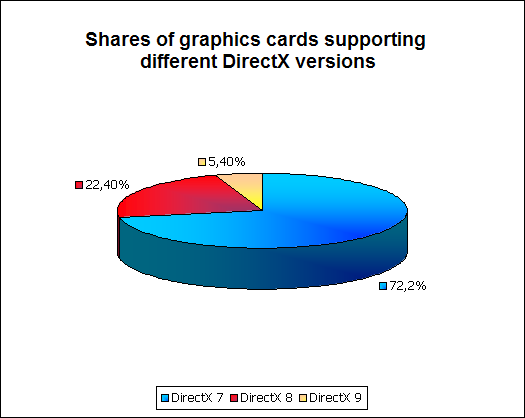

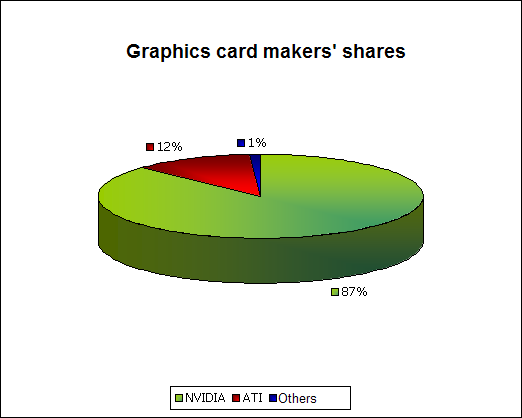

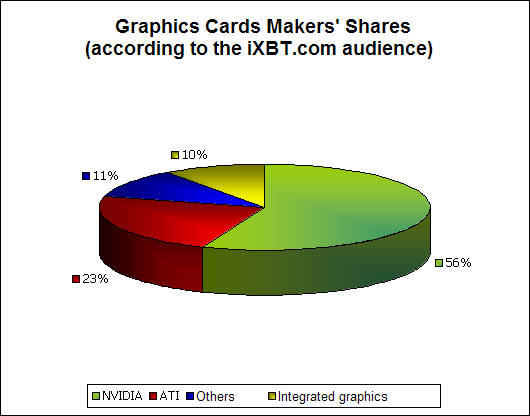

Publishing reviews of video cards we at the same time trace changes in this market segment. The Russian IT market keeps on growing, and both vendors and distributors admit it. The graphics card market is also extending. Our regular researches have provided us with quite useful and interesting data we'd like to share with you. Apart from information we receive from our readers we've got some interesting data from Russian distributors. The data are given for the second quarter of 2003. Most trade companies estimate the Russian graphics sector to be equal to 4.5M cards for 2003. This isn't an exact figure, but a predictable one. Up to 30% of graphics cards are bought for upgrade purposes. The PC market is estimated to be the same 4.5-5M units. That is why about 30% of all new PCs are equipped with integrated graphics. The average video card is priced at $50-$60. The overall situation looks as follows:  Expensive cards are mostly purchased by gaming enthusiasts or well-off people. Note that the data do not cover integrated solutions. Although the leading card makers claim that the revolution has happened, the share of DirectX 7 cards is still considerable. The developers are well aware of it and do not hurry to release games for the DirectX 9.  Now comes the most interesting diagram that demonstrates card makers' shares in our market. Note that the data had been obtained before the new lines from ATI and NVIDIA (Radeon 9800XT and GeForce 5950 Ultra) were released, and before ASUS announced its collaboration with ATI and Gigabyte partnered NVIDIA. We will see whether these events affected the layout or not.  The iXBT.com audience provides the following figures about its video cards:  So,

This is the first time we carry out such research, and next time we will increase the number of distributors interviewed and collect as much data from our readers, as possible. To complete this research we'd like to share with you the video chip makers' opinion. ATI:Alexander Zhavoronkov, Manager for Central and Eastern Europe ATI's market share estimates are closer to those of the iXBT.com audience, excluding integrated graphics. According to the sell out data acquired from our partners, that manufacture and market graphics boards based on ATI silicon, ATI's share of the Russian market for discrete VGA solutions exceeds 23%. The major reason for such a comparatively small market share is mainly relatively slow responsiveness of the Russian market to our new product line, which in our opinion is superior to competitive offerings. It is clear that the Russian market, especially in the regions outside Moscow, remembers the weaknesses of ATI drivers a few years ago. Today, our drivers are industry's benchmark in terms of compatibility, stability and performance and are frequently updated. Besides, Russian market consumes mostly entry-level low-performance VGAs, a segment where ATI partners might not be able to provide the cheapest solutions. However, in the near future this situation will change dramatically. In the past, I was in charge of OEM and retail pricing in ATI HQ in Toronto, and judging by factors affecting chipset cost such as die size, type and complexity of packaging, yield rates and fab's pricing strategy, I assume that when our mainstream products "drop" into low-end, ATI will take a clear lead in this market. ATI is an undisputed leader on the mobile market with almost 70% market share. Considering the growth of the mobile market and ATI's investments into R&D, our overall market share is expected to considerably increase. In the middle of next year, when PC industry transitions to PCI Express, ATI, which is working closely with and is a validation partner of Intel, will take a leading position in all price segments. Also, considering our recent design wins like Nintendo GameCube, Microsoft Xbox 2, a line of Motorola cell phones and Samsung digital TVs, it is expected that ATI will become a leader in many consumer market segments. Comments of our Video section editor: Let me correct the situation with the drivers (for the days went by): the current second version (WHQL) is an example of hustle and careless attitude rather than stability. NVIDIA:Roy Taylor, Sales Director EMEA NVIDIA has been investing into the Russian market for a number of years and these figures reflect our efforts and those of our partners in the region. Furthermore, NVIDIA has also been the first company to recognize the growing importance of the enormous talent within the Russian game development community. NVIDIA still has a lot more to do to reach an even wider audience and

we are increasing our investment and resource in Russia as we believe that

it will soon be amongst the top three largest regions in EMEA within the

next few years.

Alexander Vorobiev (vorobiev@ixbt.com)

Write a comment below. No registration needed!

|

Platform · Video · Multimedia · Mobile · Other || About us & Privacy policy · Twitter · Facebook Copyright © Byrds Research & Publishing, Ltd., 1997–2011. All rights reserved. |